Designed education allows better provision and quality online trading, which FXPrimus recognizes as an essential part of success. Definitely, nowadays it is almost impossible to imagine trading without a mobile trading platform, as it allows you to monitor and stay updated with the situation whenever you are. FXPrimus MT4 Mobile platform also please us with a range of technical analysis and chart option features it offers, so you may customize the already good design of the mobile platform. FXPrimus gives access to trade over 120 Instruments including Forex, Commodities, Stocks, Energies, indices, and cryptocurrencies. The account types offered by FXPrimus also reflect its strive to manage the need of both beginning traders, those that require specified conditions, and professionals. Deposit options offered by FXPrimus include Bank Wire, Local Transfers, Credit Cards, and e-wallet solutions.

- To begin with, you will first need to head to their website to open an account with this broker and then click on the “trade now” button located on the right side of the header.

- The connect tool gives clients access to the brokers news feed within the MT4 platform to keep you up to date with the latest promotions the company is running.

- MT5 was launched in 2010 and came with advanced charting tools, additional timeframes, and an updated version of MetaTrader 4.

- FXPrimus provides 24/5 customer support, ensuring traders have access when financial markets are open.

- You will then need to upload a form of identification and proof of address.

Webshop Analysis

Founded in 2009, FXPRIMUS is an online trading broker with great emphasis put towards client safety and education whilst utilising new technologies to continue to improve their offering to traders. The broker gives you seamless market access via user-friendly trading platforms with very competitive trading conditions including tight spreads, low commission fees and rapid execution speeds at the best possible prices. I was impressed by the excellent range of trading tools fxprimus review for conducting chart analysis and finding trading signals. I like how the broker gives you a choice of trading accounts depending on your strategy and has a good variety of convenient funding options. If you are a beginner, you can learn from an extensive collection of educational content whilst practising your trading on a free demo account. For those of you who are ready to start trading, the minimum deposit is just $100 and opening an account takes just a few minutes.

FXPrimus Minimum Deposit

This information is available in the broker’s footer section on their website, and it’s important to note that the list may be subject to change at the broker’s discretion. Sometimes, you may hear these types of convictions from disappointed retailers. But if you inspect these claims, most of the time you’ll see the lack of personal expertise of the traders is the main reason for failing.

Stay away if you value your money

✅Once your account has been financed and validated, you may log in to your platform and start trading. Moreover, through its investment in technology, the broker enhances the safety of trading practices. At FXPRIMUS, the safety of its clients’ assets and trading activities takes precedence.

🏆 7 Best Forex Brokers

However, FXPrimus maintains its competitive edge with a well-designed trading platform designed for expert high-frequency traders with prior trading experience. The broker’s customer support service is available via email, the broker’s website, and chat apps such as WhatsApp, WeChat, Zalo, Line, and Telegram. Like other top-class brokers, FXPrimus serves Negative Balance Protection (NBP). This feature ensures your losses will never exceed your current account balance in any adverse trading situations. Also, they guarantee the safekeeping of clients’ funds by storing them in segregated accounts with top-tier banks.

Safest Forex Brokers 2024

Although the broker does not provide much in terms of educational resources, clients can access video tutorials, live webinars, trading tools and priority support once they have opened an account. Modern brokers like FXPrimus provide advanced online trading platforms, mobile apps, financial analysis tools and educational resources. These services require significant https://forexbroker-listing.com/ investment, and in turn, FXPrimus may charge clients various fees for trading activities. Be mindful of these charges, impacting your overall FXPrimus trading profitability. FXPRIMUS has a good selection of account types suitable to different styles and needs of traders. There are 3 accounts to choose from, the variable account, ECN premium account and VIP account.

Customer support and services

The reasons behind these restrictions often stem from varying regulatory requirements, local laws, sanctions, and different business entities. Regulatory authorities have specific rules and guidelines that brokers must adhere to in order to protect investors and maintain a transparent financial market. Operating in different regions may require brokers to comply with various regulatory authorities, obtain additional licenses, or even establish separate business entities. FXPrimus operates under strict regulatory guidelines, which dictate the countries in which they can and cannot offer their services. There are certain jurisdictions where FXPrimus cannot operate, such as Australia, Belgium, Iran, Japan, North Korea, and the USA.

For the ECN premier spreads, these can drop as low as 0.01 for EUR/USD, with only a $10 commission per lot. Major and minor currency pairs are in abundance, and, if you wish to cross over to other instruments, you may also trade indices, stocks or commodities via CFDs, using the same account, which is ideal. FXPrimus has mainly focused on Forex markets, offering a great selection of different currency pairs.

Given the wealth of free and paid-for research available online, I do not consider its absence a negative. While it creates a services gap with many competitors, FXPrimus maintains a competitive environment suited for advanced high-frequency traders who do not require research. Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. FXPrimus presents clients with two regulated entities and maintains an overall secure trading environment.

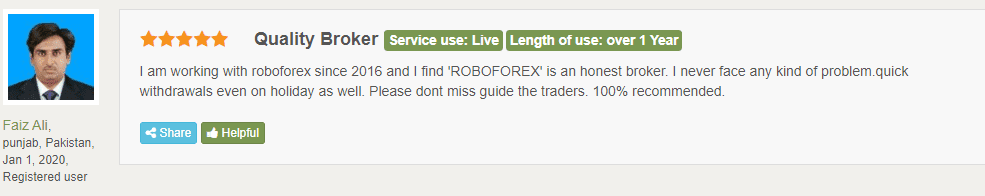

However, because the broker is regulated by the CySec, FSCA and VFSC, there is a high chance that it is not a scam. With that being said, it still does not mean that FxPrimus is the best option, as there are also hundreds of other regulated brokers with similar or even better trading conditions. FxPrimus is a broker licensed and regulated by the CySec, FSCA and VFSC. While regulation gives to brokers much needed credibility, it still does not mean every regulated broker is honest. In order to be sure that FxPrimus is not a scam, read our trader reviews and check other popular trading related websites and forums.

Leverage may magnify your exposure to markets, yet the probability of profits or losses increases in parallel, which makes it essential to learn how to use leverage smartly. Moreover, all clients trading under Negative Balance Protection will never incur any losses that exceed the account balance. As an added safety measure, FXPRIMUS has also introduced a client fund insurance of €2.5million, which is offered for free to all clients.

Placing an order is a quite simple process, as you may trade and open trade directly from the chart through a selection in the menu ‘Place Order’. Further on, and once you’re ready you can proceed with necessary verifications of your identity and open an already Live Account with all the benefits offered by FXPrimus. The EasyMarkets signup bonus is structured as a + 50% or up to USD 2000 bonus program.

Due to its headquarter in Cyprus broker is authorized to provide services to European clients as per the Cyprus Securities and Exchange Commission CySEC regulation. On the negative side, the product offering is rather narrow and is based on Forex and CFDs only, and spreads for currencies are rather high. Beyond that, the broker trading conditions and offerings vary based on the entity and there’s no 24/7 support. Also, international trading is conducted via an offshore entity which isn’t so good, however, the broker has already proven its solid reputation over these years.