In contrast, outsourced bookkeeping and accounting nearly always refers to accountants with an accounting firm who handle your books from their own office. Looking for a scalable outsourced bookkeeping service with flexible payment options? Every inDinero plan includes a dedicated account manager, direct employee reimbursements, some inventory management, and payroll assistance. It also syncs with either QuickBooks Online or Netsuite (as opposed to syncing just with QuickBooks, like most virtual bookkeepers). But there’s more than one virtual accounting company in the world, and solutions range from on-demand CFO services to simple pay-by-the-hour book balancing. Below, we review the best virtual and outsourced accounting services for small-business owners like you.

Coursera Staff

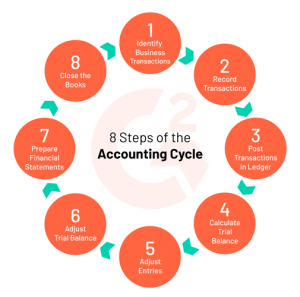

You may handle payroll functions as a bookkeeper, keep tax withholding records, and issue paychecks or send information to a contracted payroll service. Depending on the organization’s size, keeping track of business expenses and reconciling business statements may be your https://www.personal-accounting.org/ responsibility. A proper financial data management system can provide valuable, actionable insights and prevent problems, such as skimming fraud. As a bookkeeper, you oversee the first steps of the accounting cycle, while an accountant typically handles the last two.

QuickBooks Live

Outsourcing your bookkeeping tasks can make a significant difference in the day-to-day operations of your business. The staff who previously managed these responsibilities will be free to work on new projects that help to grow the business, resulting in improved morale and productivity. Without strong bookkeeping, it’s impossible for business owners to understand the financial position of their business, forecast budgets, or understand their cash position. It’s true that many large companies outsource portions of their operations, although accounting is typically one of the areas that tends to be handled by internal teams.

What Are Outsourced Bookkeeping Services?

You’ll have all the numbers you need to fill out the forms quickly with IRS-compliant reports for your tax return. It allows them to optimize their time and resources, concentrate on essential business functions, and tap into the expertise of seasoned bookkeepers. You can consider virtual bookkeeping a combination of the best in bookkeeping software and traditional bookkeeping. Virtual bookkeepers manage your books and software with the primary goal of monitoring your finances. When you go for a bookkeeping firm, you get some additional assurances not provided by solo bookkeepers. For example, a bookkeeping firm may hire professional bookkeepers with certifications.

Build a flexible, scalable outsourced accounting team to align with your firm now and as you grow

- Determine the level of support and expertise you require, whether it’s basic accounting tasks or in-depth financial analysis.

- This proactive approach minimizes the risk of errors or omissions in tax reporting, providing businesses with peace of mind and mitigating potential penalties or audits.

- You can unlock the full potential of your business while assuring thorough financial records and peace of mind by handing your bookkeeping to experienced experts.

- It’s the job of the CFO to uncover these inefficiencies and implement strategic changes to remedy them.

The main problem is that once your business develops, there will be less and less time for you to do bookkeeping yourself. We do this without adding significant overhead costs, all while helping you interview and hire pre-vetted professional bookkeepers in under 21 days. For instance, hiring a full-time in-house bookkeeper can cost your business between $33k and $54k annually. If you add benefits, payroll taxes, and other overheads, this figure shoots up dramatically. But perhaps the single most important reason you should consider working with outsourced bookkeeping companies is cost efficiency.

Top 5 Bookkeeping Audit Software

The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey. If your organization doesn’t have anyone on staff with bookkeeping knowledge, it can make sense to recruit someone who specializes in this field. You might also think about hiring an outsider who isn’t as close to your company or knows as much about its operations and can thus conduct their job objectively. As you evaluate different outsourced CFO options, there are several things to bear in mind to ensure you make the right choice.

AI and automation are significantly reducing manual data entry in bookkeeping. AI systems categorize transactions based on historical data, increasing speed and accuracy. They also use predictive analytics to forecast financial trends, aiding strategic planning. As finance and accounting outsourcing continues to grow rapidly, it’s crucial to forecast the trends shaping this sector in 2024.

You may also be expected to take on more advisory and analytical roles as bookkeeping becomes more automated. According to 81 percent of CBs who interviewed for a new job after becoming certified, having a certification contributed to getting the interview [4]. With a certified ebitda definition bookkeeper designation, you are qualified to perform all critical functions through the adjusted trial balance and basic payroll for small to medium-sized businesses. A few employers offer on-the-job training for bookkeepers by providing internships and placement programs.

However, from our experience, it is best to do so sooner rather than later. Simplify salary decisions with the Salary Calculator – a smart tool for determining fair, competitive compensation based on industry, location, and experience. Many businesses work with an outsourced CFO on a short-term project basis, although longer-term, ongoing advisory relationships are also common. Outsourced controllers also bring a tried and tested approach to helping manage your business’s finances. That know-how gives them the ability to build your business a financial infrastructure that’s resilient to all kinds of challenges.

You can hire a freelance bookkeeper, a local bookkeeper, or an accounting firm to handle your bookkeeping needs. You can get in touch with professional bookkeepers for virtual bookkeeping through an online account. The virtual bookkeeper downloads your expenses through your online banking records https://www.business-accounting.net/last-twelve-months-ltm-definition/ and merchant processor, so there’s no need to send any receipt envelopes. They will deal with your financial information, bank accounts, credit cards, invoices, and other important documents. Freelance bookkeepers collaborate one-on-one when it comes to bookkeeping and accounting needs.

To safeguard confidentiality, businesses should establish robust confidentiality agreements that outline the responsibilities and obligations of both parties. These agreements should include provisions for data protection, non-disclosure, and non-competition. While researching and evaluating online bookkeeping service providers, keep in mind the importance of strong communication and collaboration. Look for providers that prioritize responsive and proactive communication, as this will be crucial for a successful outsourcing partnership. Consider the value proposition of outsourcing – it allows you to access professional expertise without the cost of a full-time in-house bookkeeper.

If you use accrual-basis accounting, you’ll need the Growth plan, which starts at $990 a month. And the Executive plan, which is built for larger companies that need CFO services, has custom pricing. Because of these factors, advancing your bookkeeping career to a role in accounting can be advantageous. For instance, the job outlook for accountants and auditors has a 6 percent growth rate from 2021 to 2031. The median salary for these roles is also higher than for bookkeepers at $77,250 per year [4].